Best wishes for a very good new year to all our subscribers! Everyone is hoping to put 2020 behind them, the year that caused even more pain than 2019. Here, we look at key expected developments and pivotal events in the new year. Caveat: we assume, as widely expected, no further COVID shocks and a sharp economic recovery. Power demand to bounce back Based on various market estimates for GDP growth, we estimate power demand to grow by around 5-6% over last year. The demand uptick, together with steady improvement in RPO compliance, would create more demand for renewables and force DISCOMs to speed up procurement.

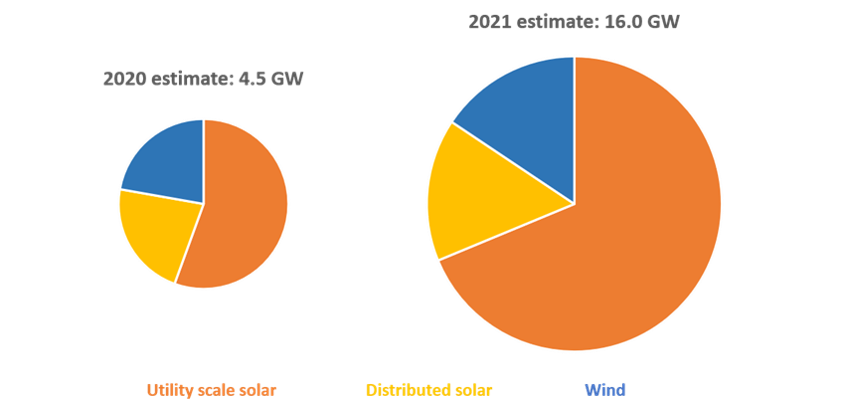

Record capacity addition We estimate total solar and wind capacity addition at about 16 GW, an all-time record high. Expected split between utility scale solar, distributed solar and wind is 11.0:2.5:2.5 respectively.

Figure: Renewable power capacity addition

Source: BRIDGE TO INDIA research

Note: Distributed solar includes rooftop solar, solar pumps and off-grid solar

Basic customs duty (BCD) imminent

Final announcement on BCD is imminent possibly coming as part of the budget on 1 February 2021. Our understanding is that there would be a time-adjusted structure ramping up over 3-4 years with lower duties for cells and higher duties on modules. Assuming that the duty level increases by 10% every year for 3-4 years, the duty would negate benefit of any fall in module prices.

Manufacturing to remain in slow lane

Domestic module manufacturing plans are stuck, awaiting progress on the 12 GW manufacturing tender (DISCOMs are refusing to accept tariff of INR 2.92), BCD, and the recently announced production-linked incentives (PLI) scheme. We believe that the resolution of the manufacturing tender would take a long time given the intractable issues posed by potential renegotiation and blending of power from other tenders. Similarly, we expect a bidding process for allocation of PLI by MNRE, which would drag out the timetable even further.

Significant fall in module prices

Global demand for modules is expected to jump to 145-150 GW this year, up about 25% over 2020. However, cell and module production capacity are increasing at an even faster rate touching a staggering 350 GW by end of the year. The massive overcapacity should result in prices falling steadily through the year, down about 12% over 2020 closing price of USD cents 0.21 per Watt.

Tariffs

If BCD is announced shortly, auction tariffs would likely stay north of the recent lows for some time.

ISTS waiver extension odds at less than 50%

ISTS waiver is currently available to projects completed by June 2023 and while, it has been extended two times in the past, another extension seems unlikely. Lack of an extension would mean that projects auctioned from around July 2021 onwards would start incurring ISTS charges leading to a shift back to state specific auctions (and consequential increase in tariffs by up to INR 0.75). The change would have critical implications for tender design and, land and transmission availability across the country.

Andhra Pradesh renegotiation

It has been a remarkable 18 months since Andhra Pradesh initiated the exercise to renegotiate and/ or terminate all renewable PPAs. A resolution has been pending in Andhra Pradesh High Court, but some developers have requested intervention from the Supreme Court. We expect final resolution, already delayed inordinately, to come sometime during the year.

Key events to look out for in the year:

- Financial condition of DISCOMs and progress on the INR 1.2 trillion liquidity package

- Power sector reforms

- Final legal resolution of Andhra Pradesh PPA renegotiation exercise

- Bidding guidelines for the PLI scheme

- Auction for the 2,500 MW renewable-conventional hybrid tender

- New unified bidding guidelines for solar, wind and hybrid projects

There is no doubt that the new year would turn out to be better than the last year. Record levels of capacity addition should soothe nerves of investors and supply chains. But the most critical step ahead is finding a permanent resolution to chronic financial troubles of DISCOMs. Delay in reform of the distribution business poses a fundamental risk to the entire power sector.

https://bridgetoindia.com/backend/wp-content/uploads/2021/01/MC24TF.jpg||https://bridgetoindia.com/backend/wp-content/uploads/2021/01/Jan-w1.png