CERC, India’s central power sector regulator, recently issued a regulation expanding scope of ancillary services and including large consumers and energy storage as potential service providers. The regulation covers mainly energy balancing services, also called frequency control, which have been split by CERC in three segments based on response time – primary, secondary and tertiary. The regulation does not yet cover other services like reactive power support and voltage control. NLDC, the national grid operator and designated nodal agency for the services, shall estimate demand for ancillary services on day-ahead and real time basis.

- Ancillary services are expected to play a critical role in growth of renewable power by improving grid security and stability;

- Trading is expected to commence in 2023 post issuance of guidelines by NLDC and launch of appropriate market instruments by the power exchanges;

- Retrofitting old plants and upskilling plant and grid operators can help by improving market capacity;

Primary ancillary services, launched for the first time, shall be fully automated and provided by power plants on an instantaneous basis. Secondary ancillary services, entailing response time of less than 30 seconds and minimum duration of 30 minutes, may be provided by power plants and consumers connected directly to the transmission grid (including those with energy storage) with a capacity/ demand greater than 1 MW. Such services shall be triggered if difference between scheduled and actual power flow exceeds 10 MW at regional level. Compensation shall include variable supply cost for power plants and a fixed charge, quoted on a monthly basis, for consumers in addition to an incentive of INR 0.10-0.50/ kWh depending on service quantum. Secondary ancillary service shall be implemented using automatic generation control (AGC) – a system that allows grid operators to send signal to power plants to change their generation profile. As of January 2022, AGC had been installed at 51 power plants.

Tertiary service may be offered by power plants and consumers with response time of 0.5-15 minutes and response duration of an hour. This service shall be triggered if quantum of secondary service exceeds 100 MW for more than 15 minutes. NLDC will seek this service on day-ahead and real-time basis on the exchanges at market clearing prices.

Next steps include: i) issuance of guidelines by NLDC for power plants and consumers to participate in the market; and ii) launch of appropriate market instruments by the power exchanges post stakeholder consultation and CERC approval. Trading is therefore expected to commence sometime in 2023.

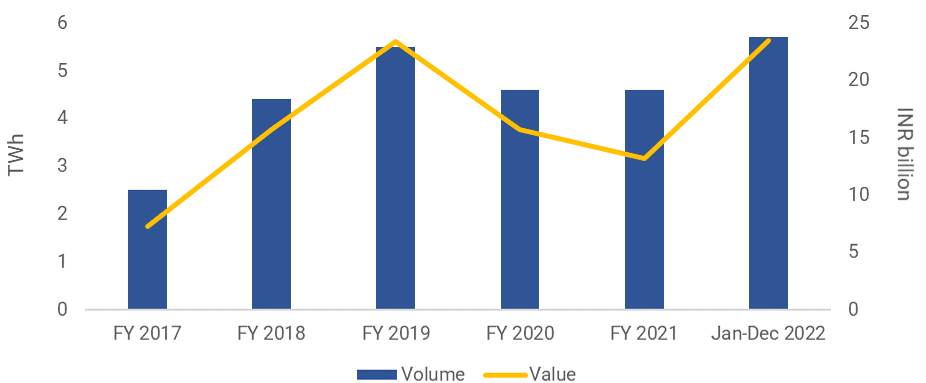

Ancillary services market became operation in India in May 2017. The current scope of services is quite simple, akin to just secondary reserve service under the latest regulation. As of January 2022, only 82 inter-state connected power plants – coal or gas fired – with aggregate capacity of 72 GW were allowed to offer this service. Market volume has been stagnant over the years but increased significantly last year.

Figure: Ancillary market volume and value in India

Source: POSOCO, BRIDGE TO INDIA research

The term, ‘ancillary services,’ refers to a vast array of services such as operating reserves, frequency control and voltage control provided by bulk energy producers and consumers to maintain grid security and stability. Expanding scope and design of such services has become extremely crucial in view of rising distributed power generation, variable renewable power supply and transmission capacity constraints. Together with demand side management, ancillary services are expected to play a huge enabling role in growth of renewable power.

Ancillary market design and requirements vary significantly across the world. Response time for secondary and tertiary services ranges from 5-15 minutes in most European countries and 6 second to 5 minutes in Australia. The UK recently added a fast reserve service with response time of less than 1-2 seconds due to increasing deployment of battery storage systems.

The market is expected to become deeper and larger over time with growth of new instruments, expansion to include intra-state markets and participation by newer technologies. Lack of readiness among power producers is a potential challenge, which needs to be overcome with retrofitting old plants and upgradation in skill sets of plant and grid operators.