BRIDGE TO INDIA hosted a webinar on 28 August 2020 to discuss rooftop solar adoption by MSME consumers. Participants included a cross section of industry stakeholders: Mr. Ravinder Singh (Chief – Solar Rooftop Business, TATA Power), Mr. Ashutosh Puntambekar (Sr. Vice President & Head, Electronica Finance), Mr. Kushagra Nandan (Co-founder, SunSource Energy) and Mr. Vivek Bhardwaj (Head of Sales – India, GoodWe); and two MSME representatives (Mr. Sandeep Kishore Jain, Managing Director, The Solo Group and Mr. Rajesh Nangia, CEO, Encoders India) that have recently installed rooftop solar systems on their premises.

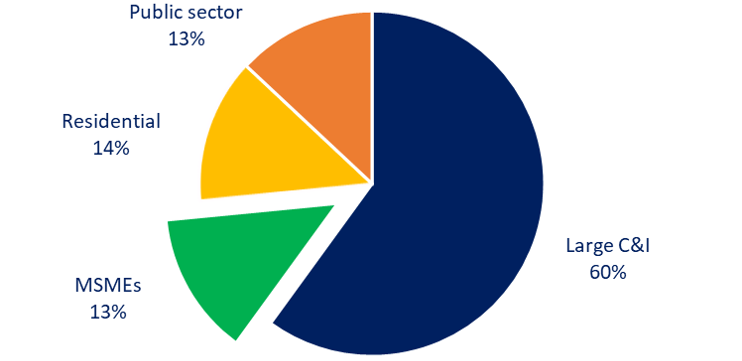

We estimate total rooftop solar installed capacity in the MSME segment at only about 800 MW, less than 15% of total rooftop solar capacity. This is exceptionally small given that MSMEs constitute more than a third of total exports and GDP and almost half of total manufacturing output and industrial power demand. Although the segment has a huge potential of 25-27 GW capacity, constraints like lack of awareness and financing options continue to hinder progress.

Figure: Rooftop solar installed capacity as on 30 June 2020

Source: BRIDGE TO INDIA research

The two MSME representatives shared their experience of installing rooftop solar systems and challenges faced. They were overall satisfied with their decision and system performance. Encouragingly, they highlighted that they were mainly focused on quality rather than prices while choosing suppliers. Both companies funded the installations internally but faced a major hurdle in securing grid connectivity approvals. Many states continue to take as long as 6-12 months to provide net-metering approvals.

All panellists agreed that the that the MSME market is very tough to penetrate because of lack of financing and insufficient understanding of rooftop solar. The two installers added that there is a lack of awareness particularly in tier 2-3 cities. Mr. Singh stated that financing systems above the size of 100 kW is a challenge for MSMEs because they do not have access to financing unlike larger players. Mr. Nandan mentioned that they see huge growth potential in MSMEs but are targeting select clusters at a time. There was a consensus on the need for hybrid and innovative business models for this market to pick up as traditional CAPEX and OPEX models are not suitable for MSMEs.

Mr. Puntambekar added that Electronica Finance is currently financing up to 75% of total cost of rooftop solar systems up to 300 kW for MSME customers. Typical interest rates are 11-14%. He mentioned that because of limited ability to repossess rooftop solar assets unlike other manufacturing machinery, a collateral is required for larger loans. Mr. Singh agreed but argued that alternate financing models with non-collateralized, lower cost solutions are critical to unlocking the MSME market.

Overall, the speakers were unanimous about the huge potential of MSME market. There are plenty of reasons to be optimistic due to rapidly improving technology landscape, falling capital costs and improving technical awareness.