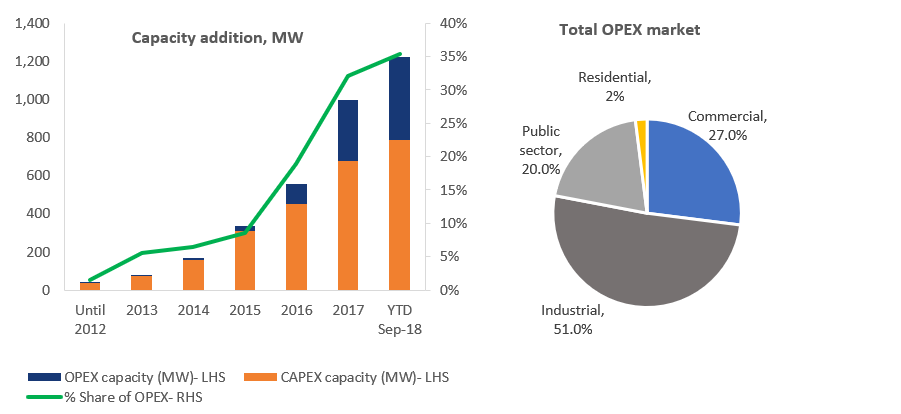

Rooftop solar market in India has seen share of OPEX model increase from barely 2% in 2012 to an estimated 35% as of September 2018. The model is growing rapidly as it is very attractive particularly for the C&I consumers – they make assured cost savings over grid power without any upfront capital investment. Plus, system installation and operation responsibility lies with specialist third party developers who have an incentive to ensure better quality and reliability.

We expect the share of OPEX model to continue to increase in the medium term and peak at it around 40% by 2020.

Figure: Capacity addition trends in the Indian rooftop solar market

Source: BRIDGE TO INDIA research

C&I consumer segment dominates the OPEX market with 78% share. The project developers prefer C&I consumers because of larger installation size (typically > 500 kW) and comfort on their long-term credit risk. Public sector consumers account for 20% share of OPEX market. Many central and state government agencies are aggregating demand from such consumers and issuing large tenders. However, progress so far has been slower than expected because of complex tender based processes and on-site execution challenges.

Residential OPEX market has still not taken off unlike in some of the western countries because of poor financial incentive for such consumers to adopt rooftop solar (low grid tariffs), poor scalability and high execution challenges.

Longer term, we believe that OPEX market share would peak at about 40% and start declining thereafter as capex costs continue to fall and consumers gain more awareness about technical and operational aspects of installing rooftop systems. This market is also bound to face growth challenges over time as the number of acceptable credit worthy C&I consumers is limited.