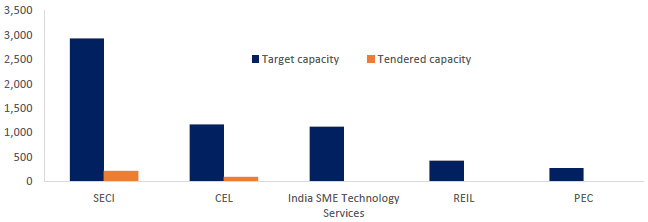

Deadline for project completion under SECI’s 1,000 MW rooftop solar tender for installation on public sector sites is coming up at the end of June 2018. The tender was issued back in December 2016. Because of various problems in the tendering process, final allocation was made for 410 MW only in December 2017. We understand that no capacity has been actually commissioned yet. Similarly, in the Central Electronics Limited (CEL) rooftop solar tender issued in January 2017, only 32 MW has been allocated so far. Other public sector specific rooftop solar tenders issued by Rajasthan Electronics and Instruments Limited (REIL) and PEC have also been similarly delayed and/or cancelled.

Public sector offers tremendous opportunity for rooftop solar with very high potential and scalability, willing consumers and better credit risk. In early 2016, MNRE had announced an ambitious target of 6 GW of rooftop solar capacity on various central government buildings in conjunction with an attractive capital subsidy scheme (equivalent to 25% of capital cost) for all public sector consumers. It subsequently appointed five public sector units to aggregate demand and procure rooftop solar systems on behalf of various end consumers. Standard PPA and EPC agreements were prepared and vetted by Ministry of Law to fast track the deployment process.

Figure: Rooftop capacity target and tendered capacity, MW

Source: BRIDGE TO INDIA research

SECI’s 1,000 MW tender is symptomatic of the various problems faced in this segment. After initial site visits by prospective bidders and further consultations with different stakeholders, tender size was reduced to 500 MW. Final allocation was further scaled down to 410 MW because of lack of private sector interest in some locations. Out of the 206 MW of capacity awarded under OPEX model, PPAs were ultimately signed for only about 95 MW by the end of May 2018.

There have been multiple problems in rooftop solar deployment on public sector buildings:

a) Actual site capacity in most cases is significantly less than estimates as site owners are reluctant to allow use of full space for various reasons;

b) Even though project sites are supposed to be already identified and screened, winning bidders are required to liaise with the respective government departments and obtain their agreement on final system size, area of deployment, business model, tariff and cost leading to delays;

c) Many government departments require the bidders to undergo further technical and financial vetting process delaying installation;

d) Some consumers are reluctant to pay capital cost upfront for budgetary reasons despite originally indicating their preference for CAPEX model;

e) Despite adverse changes in individual project sizes and/or types of roofs available, the consumers often require bidders to match lowest rates (L1) in violation of tender conditions;

f) The tenders stipulate tough conditions – minimum annual CUF, stiff completion deadlines, delay penalties, lack of payment security – forcing some leading industry players to scale back their interest. At the same time, eligibility criteria are fairly lenient resulting in a significant capacity being awarded to small local contractors with little prior experience;

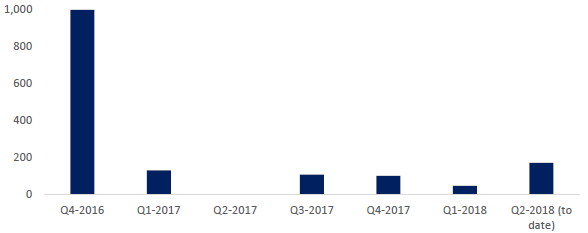

Consequently, installation delays, capacity scale back and even tender cancellations have become common in this market. Tender issuance has also failed to live up to expectations as seen in the chart below.

Figure: Rooftop solar tender issuance by public sector consumers, MW

By our estimates, public sector consumers account for only about 400 MW of total rooftop solar capacity (16% share) in the country. Many established IPPs and EPCs have aggressively targeted the public sector market but there have been few success stories (Azure financing). Unless MNRE and SECI are willing to identify and fix problems quickly, this market will fail to live up to its promise.