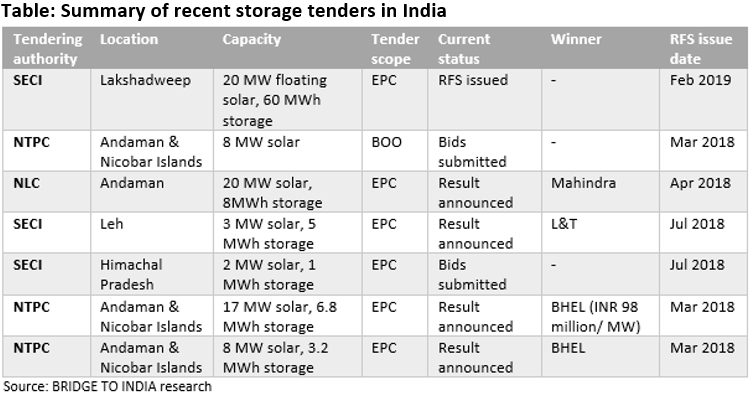

After years of anticipation, grid scale storage tenders have finally started picking pace in India. Seven tenders with a total storage capacity of 84 MWh (with 78 MW of solar PV capacity) have been issued in the last one year. These tenders have been issued by SECI, NTPC and NLC predominantly in remote areas of Jammu & Kashmir, Lakshadweep, Himachal Pradesh and Andaman & Nicobar Islands. There is huge market interest in storage tenders but participation in tenders is still limited because of specific eligibility conditions requiring minimum construction or operational experience and/ or domestically sourced content. Mahindra Susten, L&T, BHEL, Hero, S&W, IBC Solar, Exide have been amongst the most active bidders so far. There has also been some concern from the private sector that storage specifications are not clearly defined. But we believe that this aspect is improving slowly as awareness of storage technologies is improving gradually and procurement authorities are beginning to define specifications in more detail.

There have also been two new wind-solar hybrid tenders (160 MW and 600 MW) issued in Andhra Pradesh with optional storage component. India’s current grid-scale commissioned storage capacity is only 10.75 MWh. AES and Mitsubishi inaugurated a 10 MW, 10 MWh facility in Delhi. Other relatively small systems are located in remote villages in West Bengal (1.73MW), north-east (6.85 MW) and Lakshadweep islands (2.19 MW). The market holds huge potential particularly as the growing share of variable renewable energy – up from 5.6% in 2014 to 10.6% in 2018 – creates a formidable challenge in maintaining grid stability. Because of environmental and commercial concerns associated with traditional storage systems including pumped hydro, we believe that battery-based energy storage systems would dominate the market. The Government of India has been planning to issue a National Energy Storage Mission along the lines of National Solar Mission with specific targets for capacity deployment, local manufacturing and policy support. It is expected that announcement of NESM – due imminently – would provide a major boost to the market.