India’s central government recently approved some changes to promote large hydro power (capacity > 25 MW). The changes include designation of large hydro as renewable power, a sub-limit for new hydro power purchase obligation (HPO) within RPO (targets yet to be determined) and measures to make it more affordable. There is also a provision for budgetary support for enabling infrastructure, roads and bridges, up to INR 15 million/ MW depending on project size.

- The changes are desirable as they could reduce upfront cost of hydro power by 20-25%;

- Because of complex land acquisition, geological, environmental and resettlement challenges, the sector has become unattractive to private investors and financiers;

- Market-based pricing of power, creation of a vibrant ancillary services market as well as greater public sector investment are crucial for growth of the sector;

Designation as renewable power may bring some notional benefits (‘must run’ status, marginally lower cost of funding, accelerated depreciation) but the measures to reduce upfront cost of power are more important. Changes include increasing normative project life to 40 years (earlier 35 years), increasing debt repayment period to 18 years (12 years) and escalating tariffs annually by 2%. We believe that these changes, together with budgetary support, could bring down upfront tariffs by 20-25%.

Being a flexible source, large (reservoir-based) hydro power has always been talked about as an ideal balancing source for renewables. It can ramp up and down quickly, can provide peaking energy and ancillary services support to stabilise the grid. Its other main advantage is no need for any international technology or fuel source. In other words, it offers high energy security. In theory, India has an untapped potential of almost 100,000 MW of hydro power and that explains why the Indian government is so keen to support this power source.

But the benefits are outweighed by some formidable disadvantages. Hydro power is costly – capital cost ranges between INR 70-90 million/ MW – and has a long gestation period of around 8-10 years. Time and cost overruns are highly common because of complex land acquisition, geological, environmental and resettlement challenges. Over 12,000 MW of projects have been stuck in the pipeline for many years because of these challenges. Cost of power for some of the recently completed projects has come out higher than INR 8.00/ kWh. Water resource is also becoming more unpredictable.

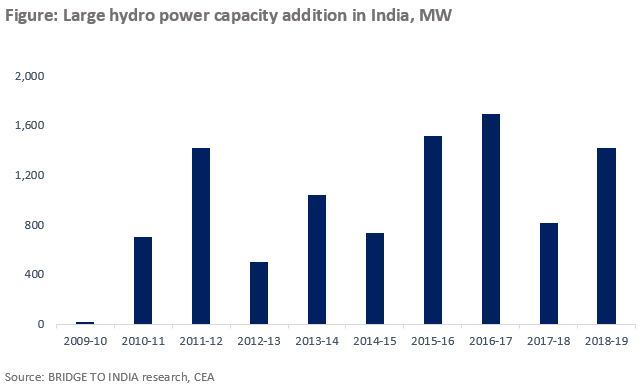

Consequently, hydro power is deemed uncompetitive with other power sources. Private investors and banks are extremely reluctant to finance such projects. According to the International Energy Agency, global capacity addition fell from 31 GW in 2008 to 24 GW in 2017. India’s hydro capacity has been nearly stagnant. Total installed capacity of 45,400 MW has barely grown in the last ten years with average annual capacity addition of just 987 MW

It is unfortunate that the unique benefits of hydro power are not valued and monetised as such, making it uncompetitive, in particular, with solar and wind power. Market-based pricing of power, creation of a vibrant ancillary services market as well as greater public sector investment are crucial for growth of the sector. But the severe operational and environmental challenges make us believe that hydro power is likely to remain a marginal source even in a best-case scenario.