In January 2019, Government of Andhra Pradesh issued a new solar policy superseding the solar policy issued in 2015. The state aims to add 5,000 MW of solar power capacity in next five years. Solar park capacity addition target for next five years is increased to 4,000 MW from 2,500 MW. The major change is the state’s abrupt pull back on open access. The state has decided to withdraw almost all incentives available to open access solar:

- Electricity duty and cross subsidy surcharge (CSS) are no longer exempted;

- Distribution losses are no longer exempted for projects injecting power at 33 kV or below;

- Wheeling and transmission charges are exempted for connecting to national transmission grid, but exemption is withdrawn for intra-state open access projects;

- Purchase of unutilized banked energy is capped at 10% of total banked energy during the year, price is reduced to 50% (100% earlier) of average pooled purchase cost (APPC);

Other relatively minor changes include support of the state nodal agency, NREDCAP, in acquiring government land for project developers. The government also proposes to give preference for power purchase, evacuation connectivity and energy banking to projects developed by local solar equipment manufacturers and related ancillaries.

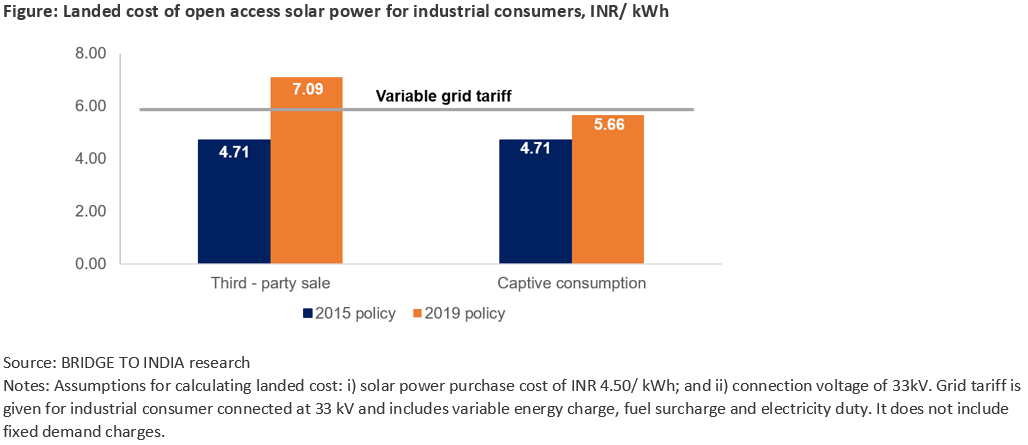

Under the earlier policy proposed to be valid until March 2020, CSS was exempted for 5 years and electricity duty, transmission and wheeling charges and distribution losses were exempted for 10 years for projects connected at 33kV or below. The new policy makes the state unattractive for open access. It increases landed cost of solar power for industrial consumers by INR 2.38/ kWh and INR 0.95/kWh for third-party sale and captive consumption respectively.

Andhra Pradesh was considered a high potential state for open access due to its attractive policy regime, relatively easy land availability and strong solar eco-system. We had estimated open access solar capacity in the state to increase from 154 MW in December 2018 to about 500 MW by March 2022. That appears highly unlikely under the terms of new policy.

The policy reversal is clearly to appease state DISCOMs, who continue to struggle financially despite financial support from UDAY scheme. In 2017, Madhya Pradesh withdrew most incentives for open access solar projects, followed by Karnataka in 2018. Haryana is still struggling to implement the policy first announced in 2016 and has recently issued an order withdrawing exemptions of OA charges for third-party sale projects. As we maintained in our recent report on open access solar, the market is being held back by policy challenges with frequent changes and negative attitude of DISCOMs and other state agencies.