DISCOMs across India are increasingly railing against private procurement of renewable energy. Following Uttar Pradesh’s recent decision to cancel net metering for C&I consumers, Andhra Pradesh and Haryana have withdrawn most incentives provided to open access solar power. And Maharashtra State Electricity Distribution Company (MSEDCL), India’s largest DISCOM, has again petitioned the state regulator for cancellation of net metering and levying wheeling charges and losses to (previously connected) net metering consumers.

- Loss of high paying C&I consumers severely hurts DISCOMs, who are pushing vigorously for a level playing field with private IPPs;

- Abrupt policy reversals give the industry no adjustment time and risk panicking investors;

- Policy risk poses the biggest challenge to private sale of power business;

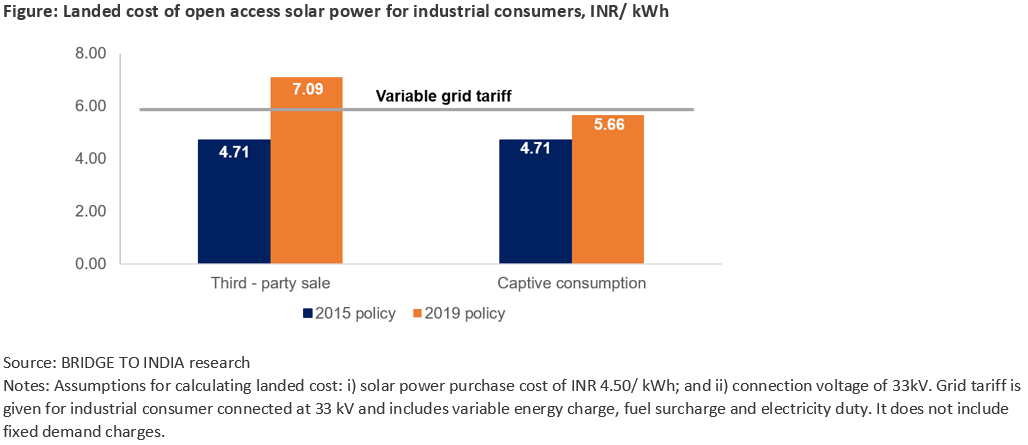

Under the state’s new solar policy, Andhra Pradesh has withdrawn almost all incentives available to open access solar. Electricity duty, cross subsidy surcharge (CSS), distribution losses and wheeling charges shall be payable by most consumers wishing to avail open access solar power. Further, purchase of unutilized banked energy is capped at 10% of total banked energy during the year with applicable price reduced to 50% (100% earlier) of average pooled purchase cost (APPC). Under the earlier policy, proposed to be valid until March 2020, CSS had been exempted for 5 years and electricity duty, transmission and wheeling charges and distribution losses were exempted for 10 years. The new policy almost overnight kills open access solar prospects in the state by increasing landed cost of power for industrial consumers by INR 2.38/ kWh and INR 0.95/ kWh for third-party sale and captive consumption respectively.

Haryana has withdrawn incentives for third party open access solar before even a single project could come up under the state’s liberal solar policy issued in 2016. MSEDCL’s petition follows its earlier unsuccessful attempt in July 2018 to replace net metering with gross metering and levy grid usage charges on rooftop solar power. This time, the regulator has stated in its order that “there is merit in the submissions of MSEDCL” and reserved judgement until a public consultation process can be completed.

Taken together, the import of all these policy moves is loud and clear. Renewable IPPs face a tough adversary in the DISCOMs. More DISCOMs are believed to be considering similar measures to block private sale of renewable power and/ or levy CSS and other grid charges on private sale of power. With equipment costs coming down significantly in the past few years, the regulators are increasingly on their side. The best-case scenario for the industry seems to be to accept some charges and hope for a gradual, more predictable shift in policy with grandfathering of existing investments. The Uttar Pradesh net metering reversal has already led to a drastic slowdown in rooftop solar market in the state. We understand that developers and contractors have suspended work on all under construction projects.