The Maharashtra regulator, Maharashtra Electricity Regulatory Commission (MERC), has made a series of positive announcements for rooftop solar market in the state. It has accepted demand from MSEDCL, a state government owned company and the largest DISCOM in the state, to levy grid usage charges on all new installations over 10 kW capacity but only once total installed capacity in the state exceeds 2,000 MW (current estimate: 810 MW). The level of approved grid usage charges is also much lower at INR 0.72-1.16/ kWh as against punitive levels of INR 3.60-8.76/ kWh sought by MSEDCL. But the consumers would incur banking charges of 7-12% with immediate effect.

- Maharashtra has become the first state in India to levy grid usage and banking charges on rooftop solar installations;

- The time-graded levy provides much needed policy clarity and could be a template for other states;

- We expect the state rooftop solar market to grow rapidly over next five years with new capacity addition of about 3,000 MW;

Notwithstanding MNRE’s move to appoint DISCOMs as nodal agencies for development of rooftop solar, MSEDCL has been trying hard to restrict this market. Back in July 2018, it had petitioned MERC to severely limit net metering connectivity for all consumers. After that demand was rejected by MERC, MSEDCL had requested levy of grid usage charges on all C&I systems over 10 kW in size. Other DISCOMs in Maharashtra (Tata Power, Adani Electricity and BEST) have not made any formal proposals to restrict net metering or levy grid usage charges.

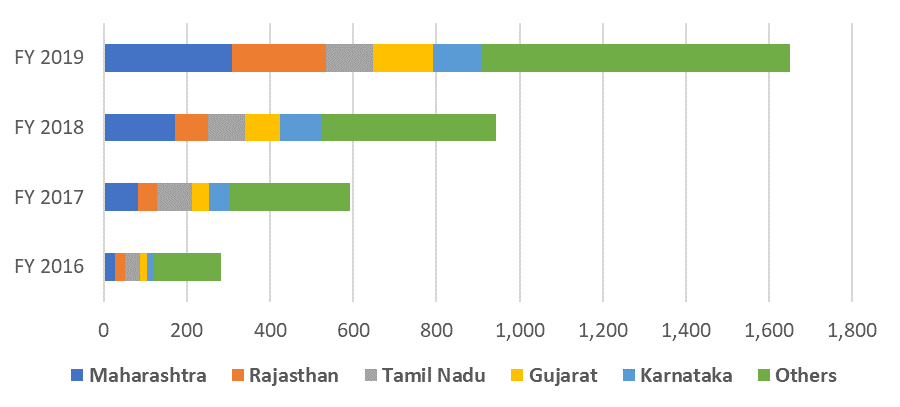

MERC decision is a pivotal moment in the development of rooftop solar market in India. It marks the first time any grid charges have been levied on such installations anywhere in the country. The other really unique and positive aspect of the decision is the policy clarity and long-term visibility afforded to the market. MERC has sensibly taken the view that rooftop solar is still too small to materially hurt financial interests of the DISCOM. By dealing decisively with policy risk, the biggest challenge in the market, it has paved way for rapid growth of rooftop solar in Maharashtra. The state, already the largest rooftop solar market in the country, had recorded near 100% growth rates in FY 2018 and FY 2019. But growth had stalled over last year because of uncertainty posed by MSEDCL petitions. We expect the state to add as much as 3,000 MW of rooftop solar capacity within five years.

Figure: Rooftop solar capacity addition by state, MW

Source: BRIDGE TO INDIA research

Separately, MERC has also approved tariff reduction of 4.3% for industrial consumers and 18.3% for commercial consumers between FY 2021 and FY 2025. Clearly, the decision comes on behest of the state government in a bid to offer financial relief to consumers post Coronavirus slowdown. Notwithstanding the tariff reduction, economic case for rooftop solar remains strong with potential savings of 30-70% for C&I consumers in the state.

Interestingly, while MERC has lowered grid tariffs, it has allowed a 13% increase in power purchase cost over next five years for MSEDCL. Quite how the DISCOM would be able to absorb the financial impact is not clear.