Indian Energy Exchange opened a new window for trading of renewable power this week. Solar and non-solar renewable power can be traded separately under four different contract types: intra-day, for delivery within 3.5 hours; day-ahead, for delivery next day; daily, for delivery between two to ten days ahead; and weekly, for delivery from Monday to Sunday. Buyers will be able to fulfil their RPO targets by purchasing renewable power on the exchange provided sellers have not been issued RECs for the same power. No revision in schedule will be allowed for intra-day and day-ahead contracts. Revisions are allowed for daily and weekly contracts but with at least two-days advance notice. Deviation penalties would be applicable as per CERC regulations (at national APPC for inter-state trading, currently INR 3.60/ kWh) or state regulations (for intra-state trading).

- Trading interest is likely to be confined to DISCOMs keen to fulfil their RPO targets;

- Price expectations may be hard to bridge as buyers look to reduce costs but sellers mainly focus on selling surplus renewable power contracted historically at much higher prices;

- Together with launch of spot trading and announcement of other new trading initiatives, the move heralds an exciting and potentially transformational opportunity for the sector;

As almost all generation capacity is tied up in firm PPAs, volumes are bound to be thin. Sellers would mostly comprise DISCOMs that have entered into renewable PPAs in excess of their RPO targets (Karnataka, Andhra Pradesh, Tamil Nadu). The buyers are also likely to be mostly DISCOMs, primarily in north and east regions, keen to buy renewable power to meet their RPO shortfall. This route would be financially more attractive than buying Renewable Energy Certificates (RECs), a market suffering from regulatory uncertainty and shrinking volumes. Interest from C&I consumers is expected to be low at least initially due to low volumes, very short-term nature of the market and open access policy constraints.

We see a few other potential issues. Price expectations of buyers and sellers may be hard to bridge. Given the surplus power situation in the country and prevailing solar auction tariffs, buyer appetite would be mainly around INR 2.50/ kWh whereas sellers would be keen to sell power contracted at much higher prices. Scheduling conditions are quite onerous with limited provision for revisions. And finally, the need to pay immediately for power may keep some buyers away. As expected, trading volume has been patchy in the early days hovering below 10 MW for most part.

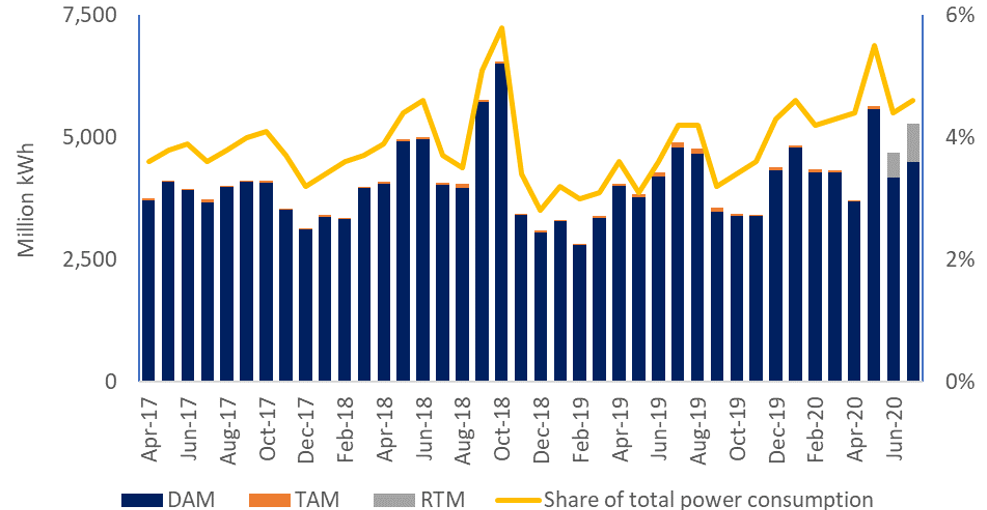

Launch of green power trading follows commencement of spot trading of power from 1 June 2020 onwards. This window is ideal for buyers and sellers in meeting their unforeseen last-minute requirements. Trading volume has already soared to 15% of total volume. Monthly average price of INR 2.31/ kWh is nearly in line with day-ahead market price of INR 2.40/ kWh.

Figure: Volume traded at Indian Energy Exchange and share of total power consumption

Source: Indian Energy Exchange, NLDC

Notes: DAM – day ahead market; TAM – term ahead market; RTM – real time market

Longer-term trading windows and new instruments including derivatives are expected to follow in near future. Another new concept proposed to be launched shortly pertains to market-based economic dispatch, whereby all power sale transactions including those under long-term PPAs would be routed through exchanges.

These are all very exciting and transformational developments for power sector in India. Although some people have voiced doubts about prospects of power trading, we believe that launch of market-based mechanisms is highly desirable and the logical next step in evolution of the market. Exchange-based trading provides more information to all market participants including financiers and consumers, and leads to greater transparency, efficiency and better decisions. However, we doubt that these moves would lead to creation of new merchant power generation capacity anytime soon as we see no financing appetite for such projects currently.